DEADLINE TO APPLY FOR 2023-24 WINTER SEASON HAS PASSED.

First time applicants have the option of applying online or submitting a paper application if that’s preferable. Applications available at our Main Office, located at 18 Chestnut Street, Worcester, Mondays-Fridays 9am-4pm.

Those unable to apply online or by visiting either our main office or remote locations can do so over the phone by calling 508-754-1176.

Please note that given the volume of applications we receive it can take quite some time for your application to be processed. You can check the status of your application by calling our automated line anytime at 508.796.2423. You can email to connect with a member of our fuel assistance team with any additional questions. Your patience is appreciated.

CLICK HERE TO APPLY ONLINE

Tips for completing your application online:

- When you start an application online, you may save your information and return to it at a future date.

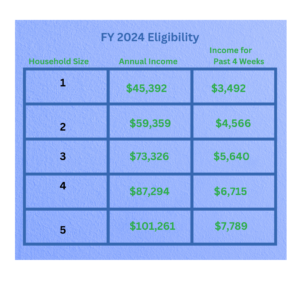

- Please be sure to include all members of your household on your application, including children. Your benefit is determined by the number of people who live in the household and your combined income.

- Online applicants should be prepared to upload supporting documents listed below from your phone, tablet or computer. It is strongly recommended to have them with you before you start the process. Incomplete applications will delay approval process. Complete applications are processed faster!

- You may bring, mail or fax documents to the agency after you submit your application. Fax # is 508-463-9696. Mailing address is 18 Chestnut Street, Suite 500, Worcester. Office is open to the public weekdays 9am-4 pm (excluding holidays).

- Please refrain from emailing personal information. Additional documents may be uploaded to the portal at any time.

Required Forms/Information:

When you apply, please provide the following:

- A copy of your current heating bill

- Picture ID for the first applicant

- Qualified alien status or citizenship verification for everyone.

- Current GROSS income (before taxes and other deductions) from all sources for all household members for the past 30 days (pay stubs from 4 weeks in a row if paid weekly or 2 if paid bi-weekly)

- Award letter for Social Security, Disability, SSI, VA, Pensions or other fixed income sources. 1099 for is also acceptable.

- If receiving child support, must complete appropriate form and provide backup documentation.

- Unemployment : monetary determination page

- Documentation for the source of Interest Income of over $100 or more

- If self-employed, a signed copy of prior year’s entire tax returns with all attachments. If self-prepared , a transcript will be requested.

- Rental Income: Previous year’s tax returns or housing cost deduction forms such as tax, water bill and insurance expenses and verification of rental income received. Household members 18 years and over who are students must provide documentation from the school.

- If over 18, not a student, and claiming no income applicants must sign a no-income statement.

- Current tenant profile if you have a rental subsidy.